Its enterprise value of $9B is roughly equal to 90 times EBITDA. For instance, LSCC trades at 113 times forward earnings with a trailing P/E of 135. The table below shows the multiples LSCC trades at. With the price of the stock rising, so too have multiples. Source: Why long LSCC may not be worth it at this point The chart below shows how the stock has steadily climbed higher in 2021. In fact, LSCC was one of the best-performing semiconductor stocks heading into the fourth quarter of 2021 as shown in another article. In comparison, the iShares PHLX Semiconductor ETF ( SOXX) has gained 20%, which is less than half. Whatever progress the quarterly numbers have made, they pale in comparison to what the stock has done. LSCC has appreciated by roughly 870% since the start of 2019. The chart below shows how the stock has surged higher. With the numbers going up, so too has the stock. The table above shows how the numbers have improved in recent years, even though the top line was kind of flat. On the other hand, revenue was flat for a couple of years prior to that. As mentioned earlier, quarterly revenue has increased sequentially for five consecutive quarters. The chart above shows how LSCC has increased its top line in recent quarters. We've engaged with over 100 customers on Avant and are pleased with customer reception of momentum."Ī transcript of the Q2 FY2021 earnings call can be found here. Execution is going well and we remain on track for launch in the second half of next year. "And lastly, at our recent Investor Day, we announced our new Lattice Avant platform, which will double our addressable market and will allow us to address mid-range FPGA applications. With Avant, LSCC believes it can double its SAM from $3B to $6B.Īvant is on track to be launched next year. The latter is targeted at the small FPGA market, whereas the former is meant for the mid-range FPGA market.

LSCC intends to do this with the addition of new products like Lattice Avant, which will complement the existing Lattice Nexus. Key to achieving this will be LSCC's ability to expand the size of its addressable market. LSCC has set a target of double-digit growth in the next three to four years with a gross margin of 65%, operating income margin of 35%+ and operating expenses of no more than 35%, all in terms of non-GAAP. While guidance did not extend beyond Q3, LSCC is expected to keep growing in the coming years. Guidance calls for the sixth consecutive sequential increase in quarterly revenue with Q3 FY2021 revenue of $124-132M, an increase of 1.7% QoQ and 24.3% YoY at the midpoint. The outlook basically sees more of the same. Licensing and Services declined by 27% YoY mostly due to a drop in revenue from royalties. Communications and Computing grew by 15% YoY. Both of the two key markets grew, but Industrial and Automotive led the way with a YoY increase of 47%. The table below breaks down revenue by end market. The table below shows the numbers for Q2 FY2021. GAAP EPS increased by 87.5% YoY to $0.15 and non-GAAP EPS increased by 47% YoY to $0.25. Q2 revenue increased by 25.2% YoY to a record $125.9M, breaking the old all-time high set in Q4 FY2016, and the fifth consecutive sequential increase in quarterly revenue. LSCC sailed past estimates on the way to a record quarter. Recent quarters have been strong for LSCC and Q2 FY2021 was not any different. However, an argument can be made that long is not necessarily the right move at this point. There's admittedly a lot to like in LSCC, which makes long LSCC almost seem like a no-brainer. The stock is steadily gaining ground, outperforming most semiconductor stocks.

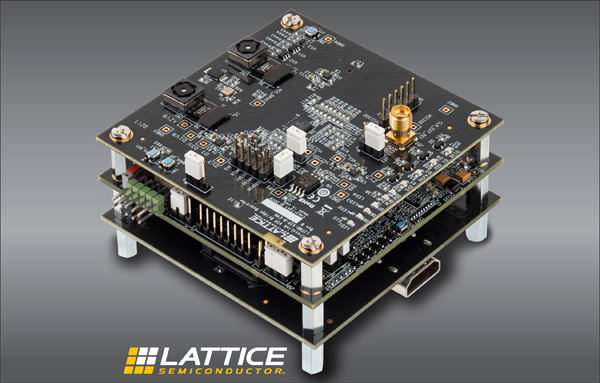

LSCC, for instance, set new quarterly records in Q2 FY2021. Lattice Semiconductor ( NASDAQ: LSCC) has done very well in 2021 in more ways than one.

0 kommentar(er)

0 kommentar(er)